Unlocking Funding Opportunities with Regulation Crowdfunding: An Introduction to Crowdfunding Vehicles

Equity Crowdfunding

Securities offerings under Regulation Crowdfunding (17 CFR § 227.100 – 504), or Crowdfunding Offerings, have become an increasingly popular way for start-ups to raise capital. The popularity of Crowdfunding offerings can be attributed to the low cost of complying with the regulation’s disclosure requirements relative to other types of securities offerings. The creation of Rule 3a-9 of the Investment Company Act of 1940 (“Rule 3a-9”) by the U.S. Securities and Exchange Commission, or the SEC, on November 2, 2020, gives rise to new funding opportunities, especially for start-up real estate investment funds and real estate development businesses.

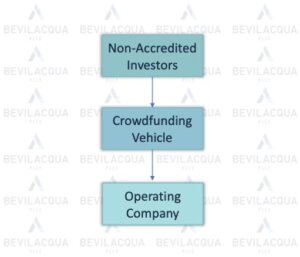

Rule 3a-9 operates as an exemption from the requirement to register with the U.S. Securities and Exchange Commission as an investment company for Crowdfunding Vehicles, an entity formed for the sole purpose of directly acquiring, holding, and disposing of securities issued by a single crowdfunding issuer, and raising capital in one or more offerings made in compliance with Reg. CF. An offering under Reg. CF involving a Crowdfunding Vehicle will result in the following basic structure:

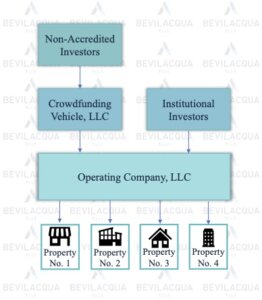

The purpose of a Crowdfunding Vehicle is to aggregate non-accredited investors in an offering into a single entity on a low-cost basis. If you were to attempt to achieve the same organizational structure outside of Regulation Crowdfunding and Rule 3a-9, it would prove cost prohibitive due to the requirement to register as an investment company and the increased disclosure requirements. The resulting structure from using a Crowdfunding Vehicle may be an intriguing prospect for real estate investment funds or real estate development businesses that may not have pursued capital funding from non-accredited investors in the past due to: (i) the involvement of institutional investors in the business who would not invest alongside potentially unsophisticated individuals; and (ii) the cost prohibitive nature of non-accredited investors into a single entity that would allow them to invest alongside such institutional investors.

However, Rule 3a-9 proposes a cost-effective solution to the two prior circumstances, and the use of a Crowdfunding Vehicle in your offering can open the door to new possibilities when it comes to capital funding. For example, by utilizing a Crowdfunding Vehicle to perform a Crowdfunding Offering of the equity securities of your real estate investment fund or real estate development business, you can diversify your business’s investor pool and raise up to $5,000,000 from non-accredited investors on a rolling 12-month basis, and your organizational structure may look like the following:

If you are interested in learning more about Crowdfunding Vehicles or other methods of capital funding, please contact Patrick G. Costello at Patrick@bevilacquapllc.com, or (202) 869-0888 (ext. 130). You can also reach us at our general information email at info@bevilacquapllc.com.